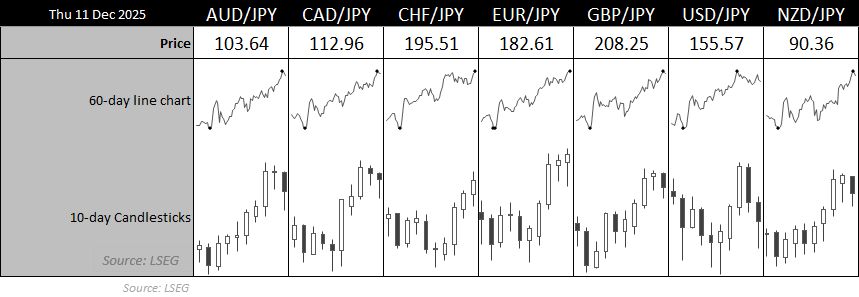

The Japanese yen continues to underperform across the FX board, with most major yen crosses extending their broader uptrends into mid-December. While short-term pullbacks have emerged, the underlying technical bias for USD/JPY, CHF/JPY and AUD/JPY remains constructive — helped along by favourable seasonality and steady demand for higher-yielding currencies. Traders should still stay nimble, with several crosses sitting near key resistance levels where volatility can flare.

Chart analysis by Matt Simpson - data source: LSEG

View related analysis:

- US Dollar Seasonality in December: USD/JPY, USD/CHF, EUR/USD, AUD/USD

- Japanese Yen Weakness Lifts USD/JPY and EUR/JPY while Nikkei Holds 50k

- Australian Dollar Outlook: Soft Jobs Cools AUD/USD Momentum

- ASX 200 Market Outlook: CBA Looks Set to Bounce, Make or Break for BXB

Technical Setups for USD/JPY, CHF/JPY and AUD/JPY

USD/JPY Technical Analysis: US Dollar vs Japanese Yen

The US dollar pulled back against the yen for a second straight session, though a late recovery on Thursday produced a bullish hammer on the daily USD/JPY chart. The lower wick held perfectly at the 155 handle — a level previously watched for potential MOF intervention — which bolsters the near-term bullish case.

On the 1-hour chart, volumes increased during the decline, but the small bullish candle at the cycle low printed on the highest volume of the session. That points to a sentiment shift at the intraday low — which aligns with the daily hammer’s wick — and underpins today’s constructive bias for USD/JPY.

Bulls may look for dips within Thursday’s range ahead of a potential break above 156. Still, with seasonal US-dollar weakness typically emerging in the second half of December, traders should stay nimble.

Chart analysis by Matt Simpson - data source: TradingView USD/JPY

CHF/JPY Technical Analysis: Swiss Franc vs Japanese Yen

The uptrend on CHF/JPY remains relentless, with the Swiss franc now pressing towards a fresh record high against the yen. The pair is tracking a fourth consecutive daily gain, and with December seasonality strongly skewed to the upside, dips continue to look attractive into the new year.

Given the strength of momentum and the seasonal tailwind, CHF/JPY bulls are likely eyeing the 200 handle. Whether it reaches that level by month-end is uncertain — but December’s historical performance suggests it has a fair chance of attempting it.

Chart analysis by Matt Simpson - data source: TradingView CHF/JPY

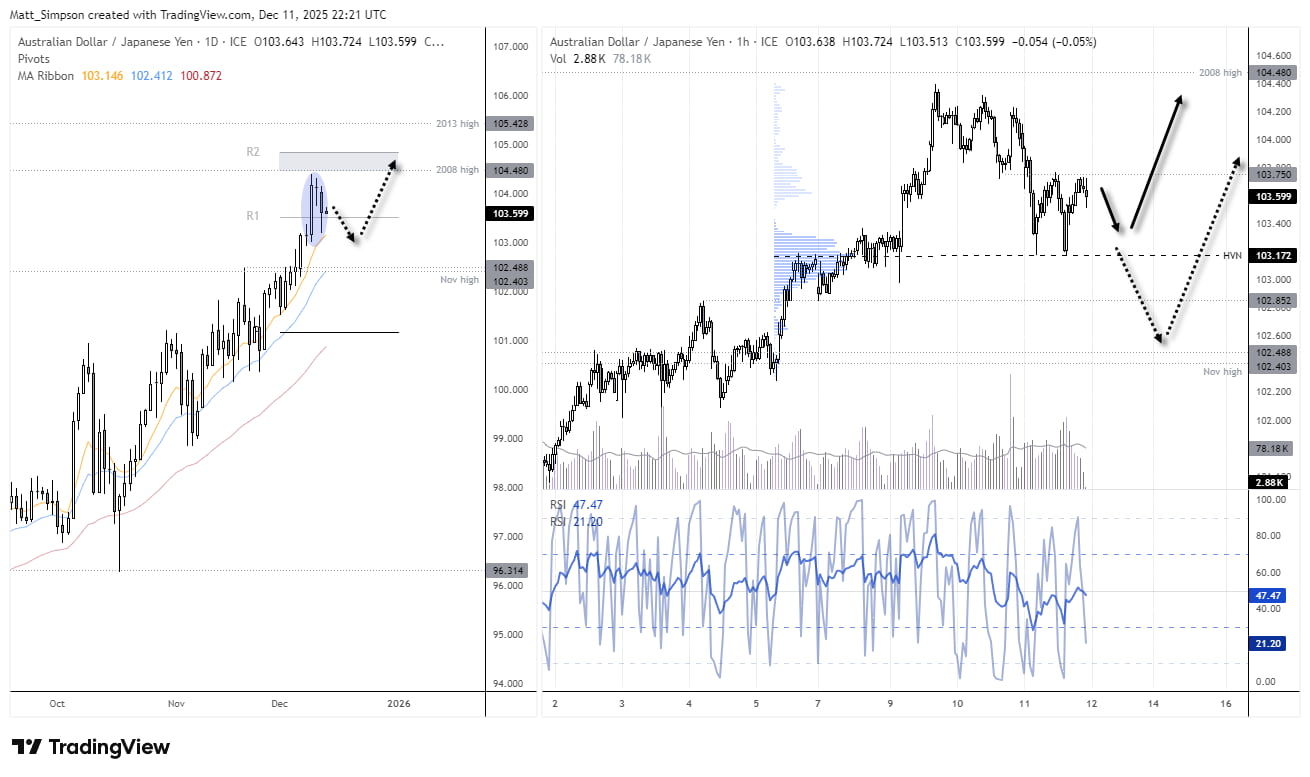

AUD/JPY Technical Analysis: Australian Dollar vs Japanese Yen

AUD/JPY is another yen cross that typically performs well in December, but the latest rally has stalled just beneath the 2008 high, triggering a short-term pullback. A bit more downside looks likely before bulls attempt to drive the next leg higher — unless an anti-seasonal risk-off move derails it.

On the 1-hour chart, a double top has formed around prior support at 103.78, with declining volumes into Thursday’s high reinforcing the loss of momentum. Bulls may look for dips within Thursday’s range while price holds above the double-bottom lows around the 103.17 high-volume node, anticipating a break back above 103.8.

Still, traders should be alert to the possibility of a deeper retracement towards 102.85 or even 102.50 before the broader upswing resumes.

Chart analysis by Matt Simpson - source: TradingView AUD/JPY

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge