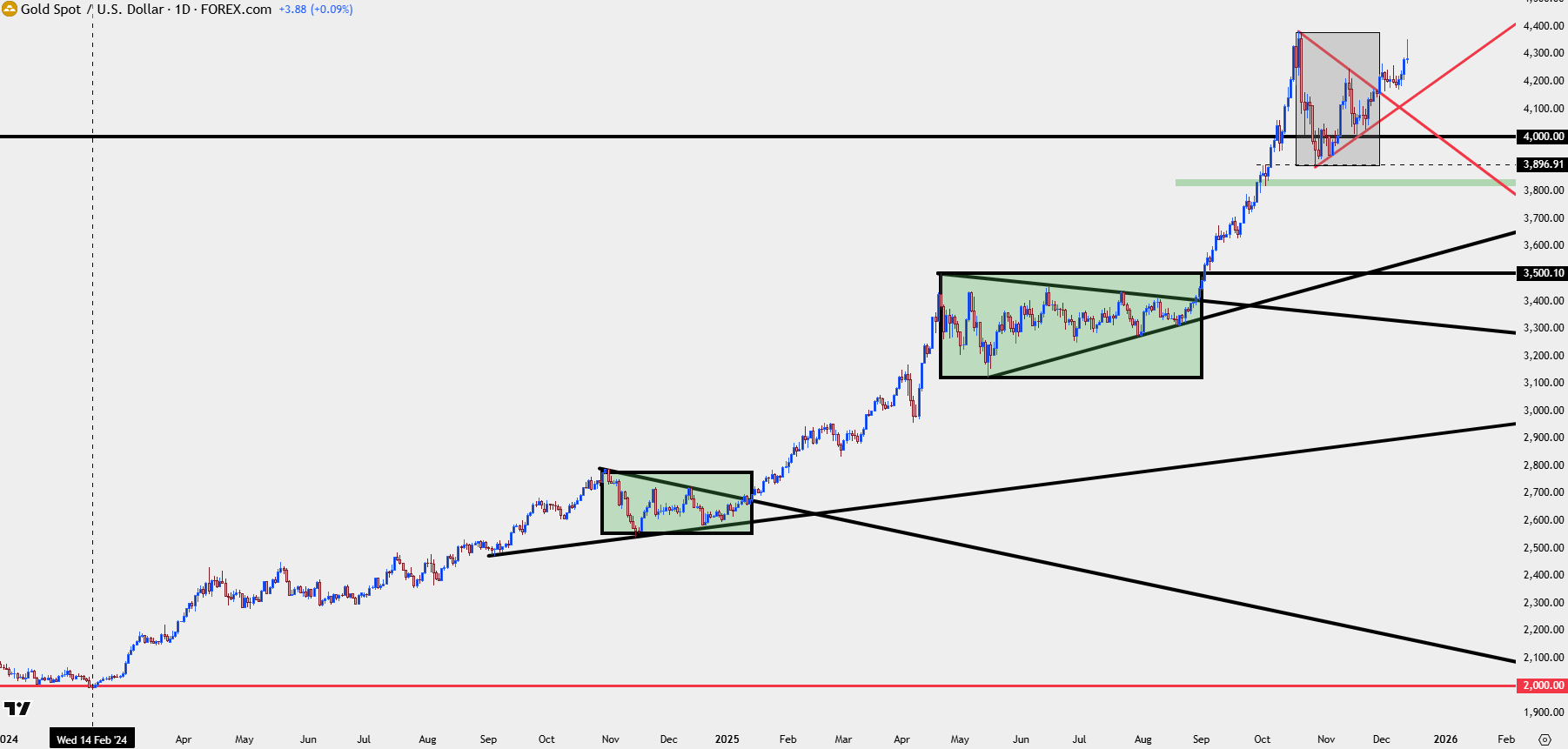

The biggest winner from this week’s Fed meeting has so far been metals, with silver jumping to a fresh all-time-high and gold prices continuing the breakout from the bull pennant formation and now re-approaching the ATH that set the highs back in October. Notably – the 4380 level held two separate tests while setting up a double top formation, and that led to the pullback and run down to 3900. But from that built a symmetrical triangle, and when taken with the prior trend, that set up another bull pennant formation, very similar to what built in the final two months of last year or the four months this year from April and through August.

The market reaction after an FOMC meeting can tell you quite a bit about how the meeting is being interpreted and the cleanest venue for that, at least in my opinion, is what’s happening in metals. Silver has continued to run to fresh ATHs but it’s the move in gold that I think is perhaps even more notable, as the longer-term structure has very much built alongside expectations for policy and supportive initiatives for growth.

I tell this story often but it was the CPI report issued on February 13th of last year where matters began to spark. At the time there was a stand-off as the Fed had been forecasting rate cuts in 2024 but inflation remained well above the bank’s 2% target. As the Fed started to forecast 2024 cuts in the SEP at the December 2023 rate decision, gold had finally started to hold above the $2k/oz level that was serving as resistance for the prior three-and-a-half years. But as we came into 2024, with hopes for rate cuts starting later in the year, gold had started to find support at the big figure – until that CPI release on February 13th.

That CPI report came out hot and legitimate worries built that the Fed’s rate cut plans for later in the year were at risk. That day we saw a rally in the US Dollar and a pullback in stocks – and gold put in its first daily close below the $2,000/oz level in 2024. It seemed there was an opportunity for re-pricing of those rate cut hopes.

And then a day later, a widely-watched Fed official, Austan Goolsbee of the Chicago Fed, said during a television interview that markets should avoid getting ‘flipped out’ about a single inflation print (even if it wasn’t just that single report that was above expectations), and this helped to drive a shift in that risk-off mood. A day later, gold pushed back above $2k and it never really looked back, driven by the idea that the Fed might cut even if inflation remained well-above their 2% target.

That’s precisely what happened in September but along the way gold had gained about 30%, finding resistance at the $2600 level at that rate cut announcement. There was an interesting short-term dynamic which I covered in these articles, but the rally continued into late-October trade when gold finally took a breather just before hitting the $2800/oz level.

Gold Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

After an intense rally, positioning can become incredibly one-sided and that can get to the point where there’s few buyers left on the sidelines to continue pushing demand higher. And the more longs there are in a market in a stretched and extended move, the more that profit taking motive can take over. This is why we can see intense pullbacks that take on a reversal tone on a short-term basis, such as the Q4 2022 and 2023 moves in USD/JPY.

But in gold, those pullbacks remained orderly for the final two months of last year, and as we came into 2025 gold simply broke out in another parabolic-like move until finally finding resistance at the psychological level of $3500/oz.

That, again, showed heavy one-sided positioning that led to pullbacks and profit taking as an orderly consolidation pattern appeared. In both instances, there were symmetrical triangle formations, that when considered with the broader bullish trend made for bull pennants.

I chronicled each at the time in these articles, and for April scenario from this year, the consolidation lasted for four months as we moved towards the Jackson Hole Economic Symposium. It was when Jerome Powell signaled his readiness to cut rates in 2025 at his speech on August 22nd that gold began to break out of the second bull pennant. And again, the metal moved into a near-parabolic like rally that ran for an extended period of time, finally finding resistance at the $4380 level in October.

Gold Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

The October pullback set up as a double top formation and that setup filled in quickly as profit taking took over once again. And, like the two episodes before, the consolidation following the parabolic-like rally remained somewhat orderly, taking the shape of a symmetrical triangle that helped to make for a bull pennant formation.

The third bull pennant started to give way to breakout two weeks ago, pushed by the news that President Trump would name Kevin Hassett as the next Fed Chair. Hassett has a history of being an uber-dove and if he is in fact the successor to Jerome Powell, and this is combined with President Trump’s prior statement that rate cuts would be a litmus test for who he nominates next, there’s reason to expect a continued dovish lean at the FOMC; even if this week’s meeting sounded perhaps a bit more hawkish than what markets were looking for in the dot plot matrix.

After finding support at 4180 a few different times in the prior week, bulls were able to stretch a breakout beyond 4250 after the FOMC meeting. That level is now an important line in the sand for bullish continuation scenarios as it now sets up higher-low support potential as we move into the end of the year.

Gold Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Market Analyst, Global Macro