The Stochastic Oscillator is a momentum indicator developed by George Lane in the 1950s. It compares a specific closing price of an asset to a range of its prices over a certain period, typically 14 periods. The Stochastic Oscillator moves between 0 and 100 and is used to identify overbought or oversold conditions, as well as potential reversal points in a market.

How the Stochastic Oscillator Works:

The idea behind the Stochastic Oscillator is that during an upward trend, prices tend to close near the high of the day, and during a downward trend, they tend to close near the low. By tracking this relationship, the Stochastic Oscillator helps traders gauge momentum and predict potential reversals.

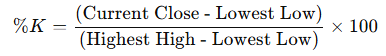

The formula for the Stochastic Oscillator is:

Where:

- Current Close is the most recent closing price.

- Lowest Low is the lowest price over the last N periods (typically 14).

- Highest High is the highest price over the last N periods.

(\%K) is the primary line, and the %D line is a 3-period moving average of (\%K), used as a signal line for buy or sell signals.

Stochastic Oscillator Levels:

- Overbought (80 and above): When the Stochastic Oscillator is above 80, it suggests that the asset is overbought, meaning it may be overvalued and a downward reversal could be near.

- Oversold (20 and below): When the Stochastic Oscillator is below 20, it suggests that the asset is oversold, meaning it may be undervalued and an upward reversal could be near.

Stochastic Oscillator Signals:

- Overbought and Oversold Conditions: Traders often use the 80 and 20 levels to identify overbought and oversold market conditions. When the indicator moves above 80, it may be a signal to sell, and when it falls below 20, it may be a signal to buy.

- Crossovers: A common trading signal occurs when the %K line crosses above the %D line in oversold conditions (below 20), signaling a buy. Similarly, when %K crosses below %D in overbought conditions (above 80), it signals a potential sell.

- Divergence:

- Bullish Divergence: Occurs when the price makes lower lows, but the Stochastic Oscillator makes higher lows, signaling that the downtrend may be losing momentum and a reversal could be near.

- Bearish Divergence: Occurs when the price makes higher highs, but the Stochastic Oscillator makes lower highs, indicating that the uptrend may be weakening and a reversal could occur.

Stochastic Oscillator Variants:

- Fast Stochastic Oscillator: This is the original version with quick sensitivity to price changes but can give more false signals in choppy markets.

- Slow Stochastic Oscillator: A smoothed version of the fast Stochastic Oscillator, it uses slower-moving averages to reduce noise and false signals.

- Full Stochastic Oscillator: This version allows traders to customize the look-back period and smoothing settings, offering more flexibility.

Advantages of the Stochastic Oscillator:

- Effective in Range-Bound Markets: It works well in identifying overbought and oversold conditions, especially in sideways or range-bound markets.

- Momentum Indicator: It helps traders understand the momentum of price movements, providing insights into potential reversals.

Disadvantages of the Stochastic Oscillator:

- False Signals in Strong Trends: In strong trending markets, the Stochastic Oscillator can remain in overbought or oversold territory for extended periods, leading to false signals.

- Lagging Indicator: Like many momentum indicators, the Stochastic Oscillator can sometimes provide signals after the price has already begun moving.

Stochastic Oscillator Trading Strategies:

- Overbought/Oversold Strategy: Traders use the 80 and 20 levels to determine potential buy or sell points. Buy signals are generated when the oscillator is below 20 and rises, while sell signals occur when the oscillator is above 80 and starts to fall.

- Divergence Strategy: Traders look for divergence between price action and the Stochastic Oscillator to identify potential reversals.

Conclusion:

The Stochastic Oscillator is a reliable and widely-used momentum indicator that helps traders identify overbought and oversold conditions and potential trend reversals. It is particularly useful in range-bound markets and is often combined with other technical indicators to confirm trading signals and improve accuracy.