The Relative Strength Index (RSI) is a momentum oscillator developed by J. Welles Wilder in 1978. It is a popular technical analysis tool used to measure the speed and change of price movements. RSI oscillates between 0 and 100 and is primarily used to identify overbought or oversold conditions in a market, as well as potential reversal points.

How RSI Works:

RSI compares the magnitude of recent gains to recent losses over a specified period (typically 14 periods) to gauge the momentum of a security’s price.

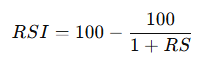

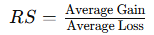

The formula for RSI is:

Where:

RSI Levels:

- Overbought (70 or above): When RSI is above 70, it is considered overbought, suggesting that the asset may be overvalued and a price correction or reversal could occur.

- Oversold (30 or below): When RSI is below 30, it is considered oversold, indicating that the asset may be undervalued and a price rebound could be imminent.

RSI Signals:

- Overbought and Oversold Conditions: Traders often use the 70 and 30 levels as signals. If RSI rises above 70, it may indicate that the asset is overbought, signaling a potential sell opportunity. If RSI falls below 30, it may indicate that the asset is oversold, signaling a potential buying opportunity.

- Divergence:

- Bullish Divergence: Occurs when the price makes a lower low while RSI makes a higher low, signaling a potential reversal to the upside.

- Bearish Divergence: Occurs when the price makes a higher high while RSI makes a lower high, signaling a potential reversal to the downside.

3. Centerline Crossover (50 level): RSI crossing above the 50 level can indicate a potential bullish trend, while crossing below 50 can signal a bearish trend.

RSI Trading Strategies:

- Overbought/Oversold Strategy: Traders look for RSI values crossing above 70 (overbought) or below 30 (oversold) to determine potential reversal points. A common approach is to sell when RSI is overbought and buy when RSI is oversold.

- Divergence Strategy: Traders watch for divergence between price and RSI as a signal that the current trend is weakening and a reversal may be imminent.

- Trend Confirmation: RSI can also be used to confirm the strength of a trend. If RSI is trending above 50, it may confirm an upward trend, and if it is trending below 50, it may confirm a downward trend.

Advantages of RSI:

- Simple and Effective: RSI is easy to calculate and understand, making it accessible for traders of all experience levels.

- Momentum Indicator: It helps traders assess the strength of a price movement and potential reversal points.

- Versatile: RSI can be used in both trending and range-bound markets.

Disadvantages of RSI:

- False Signals in Strong Trends: In strong trending markets, RSI may remain in overbought or oversold territory for extended periods, leading to false signals.

- Lagging Indicator: RSI, like most indicators, is based on historical data, so it may sometimes provide signals after the price movement has already occurred.

In summary, RSI is a versatile momentum oscillator that helps traders identify overbought or oversold conditions and potential reversals. However, it’s most effective when used in conjunction with other technical indicators to filter out false signals and confirm trends.