Exponential Moving Average (EMA) is a type of moving average that gives more weight to recent data points, making it more responsive to new information compared to the Simple Moving Average (SMA). EMA is widely used in financial markets for technical analysis to detect trends and potential entry or exit points in trading.

How EMA Works:

The EMA places a higher significance on recent prices by applying a weighting factor. The most recent price has the highest weight, while older prices progressively receive lower weights. This makes the EMA react faster to price changes than the SMA, which gives equal weight to all data points in the period.

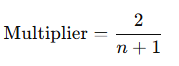

The weighting multiplier is calculated using the formula:

Multiplier

Where 𝑛 is the number of days in the moving average.

EMA Formula:

EMA is calculated using the following recursive formula:

In this formula:

- Current Price is the price of the asset on the current day.

- Previous EMA is the EMA value of the previous day.

- n is the chosen period for the EMA, such as 10 days, 20 days, etc.

Why Use EMA?

- Sensitivity to Price Changes: Since EMA gives more weight to recent prices, it is more sensitive to current market conditions, making it ideal for traders who need quicker signals.

- Trend Detection: Like the SMA, EMA helps identify trends, but its faster response to price changes makes it a better choice for short-term traders.

- Crossover Strategies: Traders often use EMAs with different periods (e.g., 50-day and 200-day EMAs) to create trading signals. When a shorter-period EMA crosses above a longer-period EMA, it is a bullish signal (buy). Conversely, when a shorter EMA crosses below a longer EMA, it’s a bearish signal (sell).

Advantages of EMA:

- Faster Reaction to Price Changes: EMA captures sudden price movements faster than SMA, providing traders with timely signals.

- Better for Short-Term Trading: Because of its sensitivity, EMA is favored by day traders and swing traders who rely on fast-moving indicators.

Disadvantages of EMA:

- False Signals: Its sensitivity to price changes can sometimes lead to false signals, especially in volatile markets. This can result in trades based on temporary price spikes or corrections.

- Overall, the Exponential Moving Average is a powerful tool for traders looking for a balance between trend detection and responsiveness to price changes, offering a dynamic approach compared to the more static Simple Moving Average.