Moving Average (MA) is a widely used statistical method in time series analysis, primarily used to smooth out short-term fluctuations and highlight longer-term trends or cycles in data. In financial markets, MA is commonly used to analyze stock prices, currency values, and other financial instruments to identify potential trends and support trading decisions.

There are two main types of moving averages:

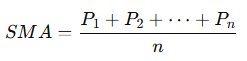

1- Simple Moving Average (SMA): It calculates the average of a selected range of prices (typically closing prices) over a specified period. For example, a 10-day SMA averages the closing prices over the last 10 days, recalculated daily as new data becomes available. The formula for SMA is:

where ( P1, P2,……, Pn ) represent the prices over the period ( n ).

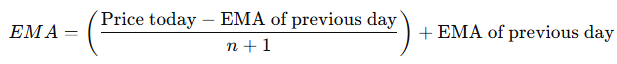

2 – Exponential Moving Average (EMA): Unlike the SMA, the EMA gives more weight to recent data points, making it more sensitive to recent price changes. This is achieved using a smoothing factor, typically 2 / (n + 1), where ( n ) is the number of days in the moving average. EMA is often preferred by traders because it reacts more quickly to price changes than the SMA. The EMA formula is more complex and is calculated as:

Uses of Moving Averages:

- Trend Identification: A rising MA suggests an upward trend, while a falling MA indicates a downward trend.

- Support and Resistance: MA lines can act as support or resistance levels in technical analysis.

- Crossover Strategy: Traders often use crossovers (when a shorter-term MA crosses a longer-term MA) to signal buy or sell opportunities.

Moving averages are fundamental tools in technical analysis, helping traders and analysts identify potential market trends and make more informed decisions.