💫Taiwan banks will launch a crypto custody trial in 2025.

Three private banks have already applied for the program.

Firms must comply with cybersecurity and AML measures.

💫RWA protocols doubled in DeFi.

Tokenization facilitates asset trading.

RWA space expected to exceed trillion dollars

💫Major US banks expect a decline in third quarter profits.

Higher deposit costs and lower net interest income were effective.

Investment banking revenues are expected to increase.

💫Bitcoin fell below 61 thousand dollars.

PlusToken scandal increased selling pressure.

Altcoins are generally in a downtrend.

💫When we look back at the bull trends of previous years, we see a search for a final bottom in all of them without exception…We are in the same situation now, the only difference is that our conditions and decline factors are quite severe compared to previous periods, and this both prevents new investor entry and creates an unfavorable environment that forces investors trying to hold on inside to exit.

💫South Korea FSC investigates Upbit’s monopoly structure.

Upbit has been criticized for its relationship with K-Bank.

💥💥💥

Today our market seems to be flatlining and trying to recover…

✅ US inflation data will be released at 15:30.

💫Bitcoin is trading at $ 60,913, down 2.5% at the time of writing, and at 2,142,095 TL against the Turkish lira.

Ethereum (ETH) down 2%

💫The dollar index (DXY) is hovering at 102.88.

Bitcoin’s market capitalization is around $ 1.23 trillion, while the total value of the cryptocurrency market is around $ 2.27 trillion.

The 24-hour cryptocurrency market volume is hovering around $ 86 billion.

💫Dolar/TL is at 34.23 with an increase of 0.1%, while the Euro/TL pair is at 37.56 with an increase of 0.3%.

💫In the last 24-hour period, $ 162 million was liquidated from the cryptocurrency market, while more than 58 thousand cryptocurrency investors were affected.

While long positions accounted for 85.44% of the liquidated positions, the most liquidation took place in Bitcoin (BTC).

💥Let’s see what is this plus token that worries us:

PlusToken was a China-based cryptocurrency Ponzi scheme that defrauded more than 2.6 million people in 2018 and 2019. Over $14 billion in Bitcoin, Ethereum, and other cryptocurrencies were seized in operations conducted by local police. According to a court document, these assets were transferred to Beijing Zhifan Technology Co. to be cashed out and used for compensation.

According to ErgoBTC, the bulk of the Bitcoins seized from PlusToken (worth around $1.3 billion) were sold between 2019 and 2020. But 542,000 ETH (worth about $1.29 billion) remained hidden in thousands of mixing addresses until this August. In August, these ETH were distributed to 294 new addresses.

ErgoBTC noted that these movements could create new supply pressure on Ethereum.

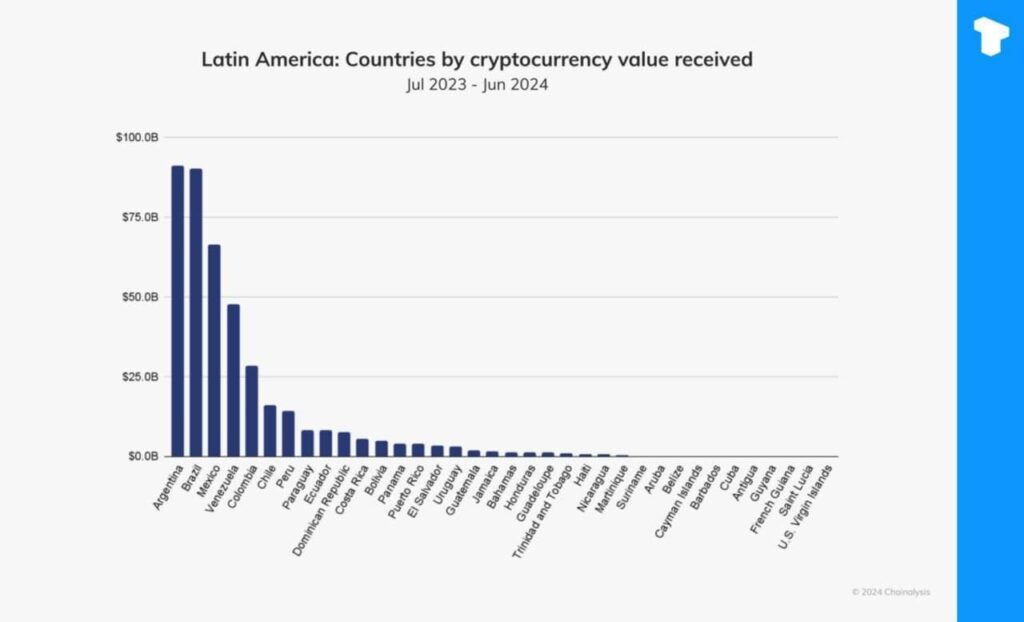

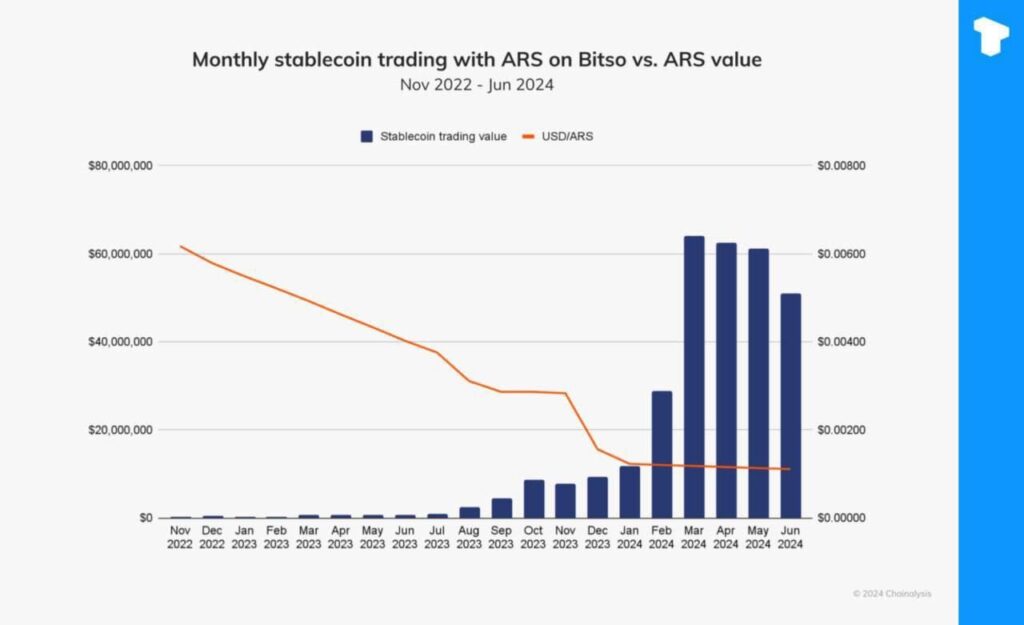

According to a Chainalysis report, Argentina leads Latin America in terms of the value generated in cryptocurrencies with an estimated $91.1 billion.

Argentina saw an increase in the use of stablecoins due to inflation; 61.8% of cryptocurrency transactions were made with stablecoins.

💫On October 9, spot Bitcoin ETFs saw outflows of $30 million. Spot Ethereum ETFs did not experience any inflows or outflows.

💥Cryptocurrency analysis company Santiment announced the 20 cryptocurrencies with the lowest investor sentiment.

Chainlink (LINK)

Ethereum (ETH)

Bitcoin (BTC)

Solana (SOL)

XRP (XRP)

Optimism (OP)

Polygon (MATIC)

Sui (SUI)

Cronos (CRO)

Phantom (FTM)

Avalanche (AVAX)

Cardano (ADA)

Render (RENDER)

Floki (FLOKI)

Pepe (PEPE)

Toncoin (TON)

Filecoin (FIL)

Injective (INJ)

Shiba Inu (SHIB)

Tron (TRX)

💥With the decline in Bitcoin and Ethereum prices, spot Bitcoin and Ethereum ETFs saw outflows of 105 BTC and 3,442 ETH, respectively, on October 9.

Fidelity’s FBTC ETF and Bitwise’s Ethereum ETF recorded the largest outflows.

Translated with DeepL.com (free version)