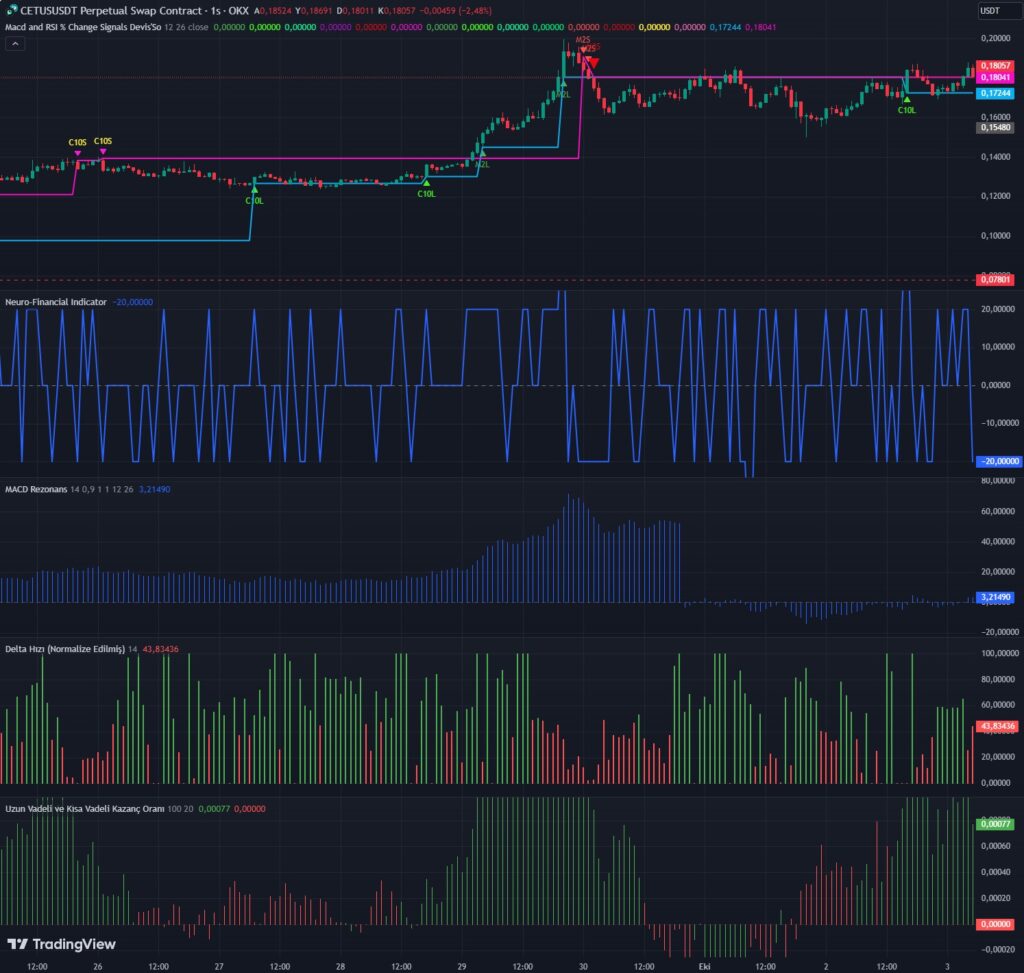

20% change creates very strong candles and leads to trend reversals. When 10% candles form, you can trade in a way that liquidates these candles. Similarly, for MACD, there are strengths of 2%, 3%, 4%, and 5%. Strong candles indicate trend reversals.

Sürüm Notları

20% change creates very strong candles and leads to trend reversals. When 10% candles form, you can trade in a way that liquidates these candles. Similarly, for MACD, there are strengths of 2%, 3%, 4%, and 5%. Strong candles indicate trend reversals.

Sürüm Notları

20% change creates very strong candles and leads to trend reversals. When 10% candles form, you can trade in a way that liquidates these candles. Similarly, for MACD, there are strengths of 2%, 3%, 4%, and 5%. Strong candles indicate trend reversals. Add 2pulback levels.

Pine Script™ indikatörü

Macd and RSI % Change Signals

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © engineerofmoney

//@version=5

indicator(“Macd and RSI % Change Signals Devis’So”, overlay=true)

logHigh = math.log(high)

logLow = math.log(low)

logClose = math.log(close)

rsihigh = ta.rsi(logHigh, 14)

rsilow = ta.rsi(logLow, 14)

rsiclose = ta.rsi(logClose, 14)

// RSI değişimi

rsiChangehigh = ta.change(rsihigh)

rsiChangelow = ta.change(rsilow)

rsiChangeclose = ta.change(rsiclose)

long_signal1 = ta.crossover(rsiChangeclose, 20)

long_signal2 = ta.crossover(rsiChangeclose,10)

long_signal3 = ta.crossover(rsiChangelow, 20)

short_signal1 = ta.crossunder(rsiChangelow, -20)

short_signal2= ta.crossunder(rsiChangeclose, -20)

short_signal3= ta.crossunder(rsiChangeclose,-10)

// Getting inputs

fast_length = input(title = “Fast Length”, defval = 12)

slow_length = input(title = “Slow Length”, defval = 26)

src = input(title = “Source”, defval = close)

signal_length = input.int(title = “Signal Smoothing”, minval = 1, maxval = 50, defval = 9, display = display.data_window)

sma_source = input.string(title = “Oscillator MA Type”, defval = “EMA”, options = [“SMA”, “EMA”], display = display.data_window)

sma_signal = input.string(title = “Signal Line MA Type”, defval = “EMA”, options = [“SMA”, “EMA”], display = display.data_window)

// Calculating

fast_ma = sma_source == “SMA” ? ta.sma(src, fast_length) : ta.ema(src, fast_length)

slow_ma = sma_source == “SMA” ? ta.sma(src, slow_length) : ta.ema(src, slow_length)

macd = ta.change(ta.rsi((fast_ma – slow_ma),100))

signal =ta.change( ta.rsi(sma_signal == “SMA” ? ta.sma(macd, signal_length) : ta.ema(macd, signal_length),100))

top=(macd+signal)/2

long_signal11 = ta.crossover(macd,2) or ta.crossover(signal,2) or ta.crossover(top,2)

long_signal21 = ta.crossover(macd, 3) or ta.crossover(signal, 3) or ta.crossover(top,3)

long_signal31 = ta.crossover(macd, 4) or ta.crossover(signal, 4) or ta.crossover(top, 4)

long_signal41 = ta.crossover(macd, 5) or ta.crossover(signal, 5) or ta.crossover(top, 5)

short_signal11 = ta.crossunder(macd, -2) or ta.crossunder(signal, -2) or ta.crossunder(top, -2)

short_signal21= ta.crossunder(macd, -3) or ta.crossunder(signal, -3) or ta.crossunder(top, -3)

short_signal31= ta.crossunder(macd, -4) or ta.crossunder(signal, -4) or ta.crossunder(top, -4)

short_signal41= ta.crossunder(macd, -5) or ta.crossunder(signal, -5) or ta.crossunder(signal, -5)

// Plot long signals

plotshape(series=long_signal1, location=location.belowbar, color=color.green, style=shape.triangleup, text=”C20L”, size=size.normal, textcolor=color.green)

plotshape(series=long_signal2, location=location.belowbar, color=#44f321, style=shape.triangleup, text=”C10L”, size=size.tiny, textcolor=#44f321)

plotshape(series=long_signal3, location=location.belowbar, color=color.rgb(26, 231, 146), style=shape.triangleup, text=”L20L”, size=size.normal, textcolor=color.rgb(26, 231, 146))

// Plot short signals

plotshape(series=short_signal1, location=location.abovebar, color=#c50fda, style=shape.triangledown, text=”L20S”, size=size.small, textcolor=color.red)

plotshape(series=short_signal2, location=location.abovebar, color=color.rgb(251, 7, 19), style=shape.triangledown, text=”C20S”, size=size.normal, textcolor=#ee07db)

plotshape(series=short_signal3, location=location.abovebar, color=#fe16d7, style=shape.triangledown, text=”C10S”, size=size.tiny, textcolor=color.yellow)

// Plot long signals

plotshape(series=long_signal11, location=location.belowbar, color=color.green, style=shape.triangleup, text=”M2L”, size=size.tiny, textcolor=color.green)

plotshape(series=long_signal21, location=location.belowbar, color=#44f321, style=shape.triangleup, text=”M3L”, size=size.small, textcolor=#44f321)

plotshape(series=long_signal31, location=location.belowbar, color=color.rgb(26, 231, 146), style=shape.triangleup, text=”M4L”, size=size.normal, textcolor=color.rgb(26, 231, 146))

plotshape(series=long_signal41, location=location.belowbar, color=color.lime, style=shape.triangleup, text=”M5L”, size=size.large, textcolor=color.lime)

// Plot short signals

plotshape(series=short_signal11, location=location.abovebar, color=color.red, style=shape.triangledown, text=”M2S”, size=size.tiny, textcolor=color.red)

plotshape(series=short_signal21, location=location.abovebar, color=color.rgb(238, 7, 18), style=shape.triangledown, text=”M3S”, size=size.small, textcolor=color.rgb(238, 7, 18))

plotshape(series=short_signal31, location=location.abovebar, color=color.yellow, style=shape.triangledown, text=”M4S”, size=size.normal, textcolor=color.yellow)

plotshape(series=short_signal41, location=location.abovebar, color=#f06ab2, style=shape.triangledown, text=”M5S”, size=size.large, textcolor=#f06ab2)

// Pullback seviyelerini tutmak için değişkenler

var float longPullbackLevel = na

var float shortPullbackLevel = na

// Long sinyalleri oluştuğunda low seviyesini pullback olarak kaydet

if long_signal1

longPullbackLevel := low

if long_signal2

longPullbackLevel := low

if long_signal3

longPullbackLevel := low

if long_signal11

longPullbackLevel := low

if long_signal21

longPullbackLevel := low

if long_signal31

longPullbackLevel := low

if long_signal41

longPullbackLevel := low

// Short sinyalleri oluştuğunda high seviyesini pullback olarak kaydet

if short_signal1

shortPullbackLevel := high

if short_signal2

shortPullbackLevel := high

if short_signal3

shortPullbackLevel := high

if short_signal11

shortPullbackLevel := high

if short_signal21

shortPullbackLevel := high

if short_signal31

shortPullbackLevel := high

if short_signal41

shortPullbackLevel := high

// Long ve short pullback seviyelerini grafikte çiz

plot(longPullbackLevel, title=”Long Pullback Seviyesi”, color=color.rgb(11, 174, 238), linewidth=2)

plot(shortPullbackLevel, title=”Short Pullback Seviyesi”, color=#f50dc3, linewidth=2)