💫Bitcoin is trading at $61,189, down 0.3% at the time of writing, and at 2,099,470 TL against the Turkish lira.

Ethereum (ETH) down 3.3

💫The dollar index (DXY) is hovering at 101.84.

Bitcoin’s market capitalization is around $ 1.21 trillion, while the total value of the cryptocurrency market is around $ 2.22 trillion.

The 24-hour cryptocurrency market volume is hovering around $ 119 billion.

💫Dolar/TL is at 34.22 with an increase of 0.12%, while the Euro/TL pair is at 37.74 with a 0.13% decrease.

💫In the last 24-hour period, $ 236 million was liquidated from the cryptocurrency market, while more than 85 thousand cryptocurrency investors were affected by this situation.

While 75.35% of the liquidated positions were long positions, the most liquidation took place in Bitcoin (BTC).

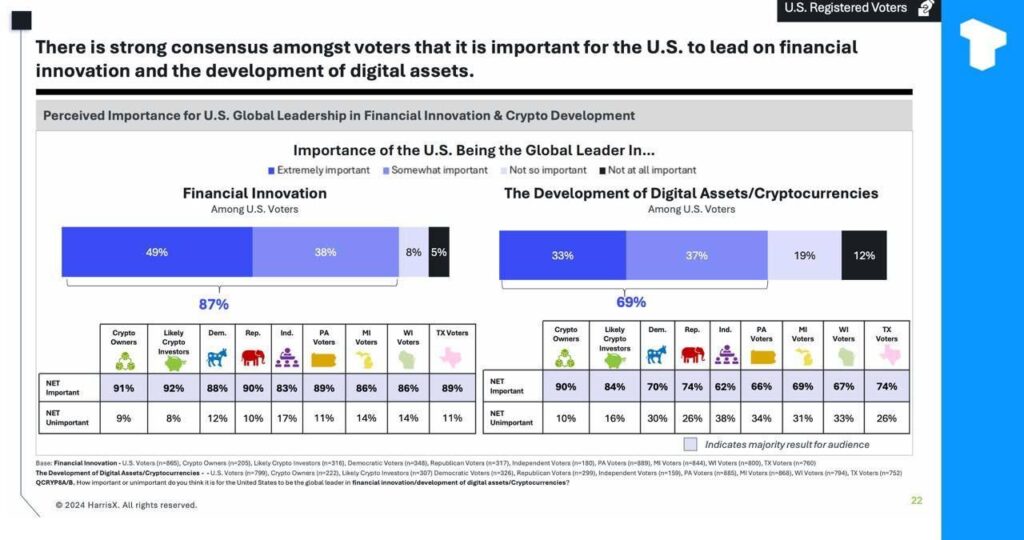

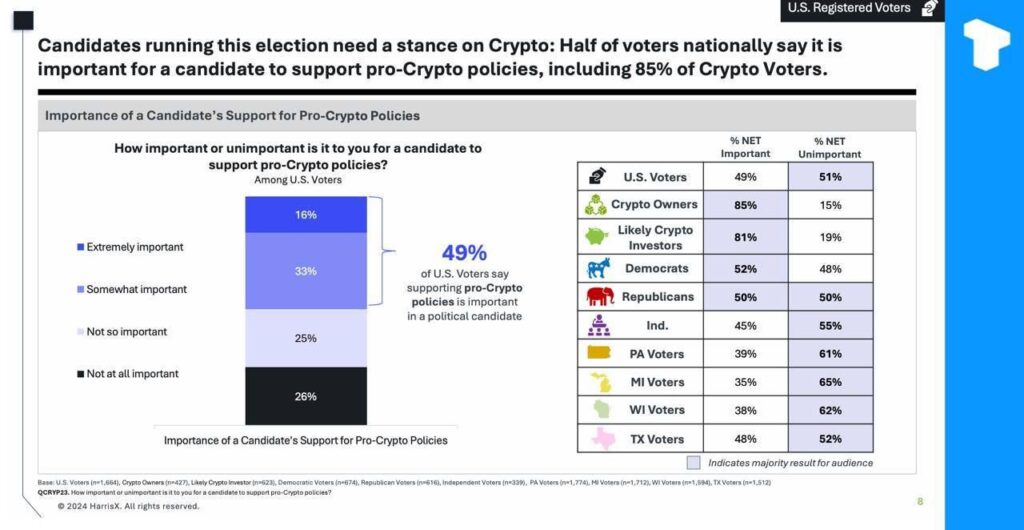

The Consensys survey shows that almost half of US voters think cryptocurrencies are important in the upcoming elections.

⚫️ 85% of cryptocurrency holders want pro-crypto policies from presidential candidates

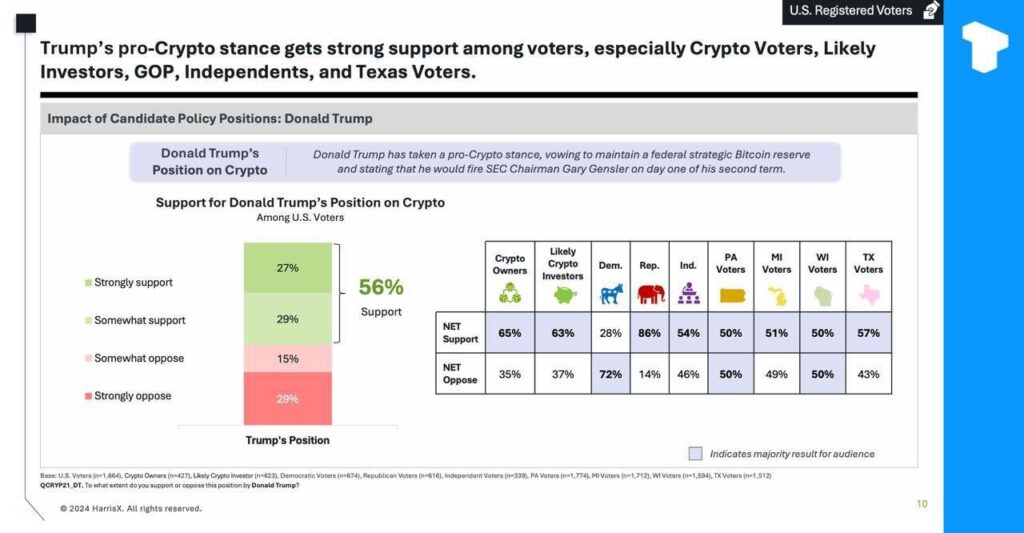

⚫️ 56% of voters support Trump’s pro-crypto approach, 54% want Harris to clarify her position

⚫️ Swing states like Michigan and Pennsylvania could be affected by candidates’ crypto positions

💥The First Statement From Ripple After The SEC Appealed In The XRP Case!

Ripple Official Stuart Alderoty Hinted at the Possibility of a Cross-Appeal in the XRP Case

💥Franklin Templeton has applied to the SEC for a Bitcoin and Ethereum ETF.

The fund provides the opportunity to invest in Bitcoin and Ethereum at the same time.

BNY Mellon and Coinbase Custody will be involved in the management of the fund.

The latest data shows that BlackRock’s IBIT ETF holds 367,000 Bitcoins, about 1.7% of the total 21 million BTC. Eleven US funds combined hold 926,638 Bitcoins, worth $56.7 billion. Since the launch of the new funds in early 2024, Grayscale’s GBTC has seen over $20 billion in outflows.

💥Bybit announced that its users can trade major stock market indices such as Dow Jones, Nasdaq, Nikkei, etc. using USDT.

💥US national debt increased by $204 billion on the first day of the fiscal year.

The budget deficit increased by 24 percent in August.

Social security and health expenditures increased significantly.

💥💫Swift will allow banks to make token transfers from 2025 to help Blockchain adoption.

💥OKX exchange announced it will list #PYUSD.

💥Aptos (APT) became one of the Layer 1 networks where traders can trade shares of Franklin Templeton’s OnChain US Government Money Market Fund (FOBXX), which manages $1.5 trillion in assets.

💥SEC has appealed the August 7 ruling in the Ripple case, specifically regarding Ripple’s payment of a $125 million penalty, which is lower than the $2 billion requested by the SEC.

According to Fox Business reporter Eleanor Terrett, Ripple has 14 days to file an appeal against the SEC’s appeal.

CEO Brad Garlinghouse also reiterated the recent judgment that XRP is not a security.

💥The US CFTC (US Department of Commerce) has approved guidelines allowing tokenized money market funds to be used as collateral in traditional financial transactions.

💥OpenAI received $6.6 billion in investment, growing from a valuation of $29 billion in 2023 to a valuation of $157 billion. Major investors include Microsoft, Nvidia, SoftBank and others.