The Price Rate of Change (ROC) is a momentum-based technical analysis indicator that measures the percentage change in price over a specified time period. It helps traders assess the strength and direction of price movements, making it a valuable tool for identifying potential buy or sell signals. The ROC can be applied to various financial instruments, including stocks, commodities, and forex.

Key Features:

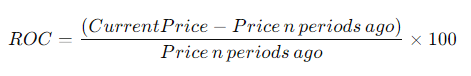

- Formula: The ROC is calculated using the following formula:

2. Range:

- The ROC can range from negative to positive values. A positive ROC indicates that the current price is higher than the previous price, while a negative ROC indicates that the current price is lower.

- The ROC does not have fixed upper or lower bounds, which means it can exhibit significant fluctuations during volatile market conditions.

3. Interpretation:

- Positive Values: When the ROC is above zero, it indicates upward momentum, suggesting that prices are increasing.

- Negative Values: When the ROC is below zero, it indicates downward momentum, suggesting that prices are decreasing.

- Overbought/Oversold Conditions: High positive values may indicate an overbought condition, while low negative values may indicate an oversold condition.

4. Usage in Trading:

- Entry and Exit Signals: Traders often look for crossover signals. A crossing above zero can signal a potential buying opportunity, while a crossing below zero may signal a selling opportunity.

- Trend Confirmation: The ROC can help confirm the strength of a trend. A consistently rising ROC indicates strong upward momentum, while a consistently falling ROC indicates strong downward momentum.

- Divergence: Traders also watch for divergences between the ROC and price movements. For example:

- Bullish Divergence: If the price is making new lows but the ROC is making higher lows, it may indicate weakening selling pressure and a potential reversal upward.

- Bearish Divergence: If the price is making new highs but the ROC is making lower highs, it may suggest weakening buying pressure and a potential reversal downward.

5. Advantages:

- Simple Calculation: The ROC is straightforward to calculate and interpret, making it accessible for traders of all skill levels.

- Versatility: It can be applied to different markets and timeframes, enhancing its usability across various trading strategies.

6. Limitations:

- False Signals: Like many momentum indicators, the ROC can produce false signals, particularly in choppy or sideways markets where price movements are less consistent.

- Lagging Indicator: The ROC may lag behind actual price movements during rapidly changing market conditions, leading to potential missed opportunities.

Conclusion:

The Price Rate of Change (ROC) is a valuable momentum indicator that helps traders assess price trends and potential reversals. By measuring the percentage change in price over time, the ROC provides insights into the strength and direction of price movements. However, as with any technical analysis tool, it is best used in conjunction with other indicators and analysis methods to confirm trading decisions and minimize the risk of false signals.