The Chande Momentum Oscillator (CMO) is a technical analysis tool developed by Tushar Chande. It is designed to measure the momentum of a price trend by calculating the difference between recent gains and losses. The oscillator helps traders identify overbought and oversold conditions, trend strength, and potential price reversals. The CMO is somewhat similar to the Relative Strength Index (RSI), but it has unique properties that make it a favored tool for detecting momentum shifts.

Key Features:

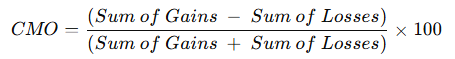

- Formula: The Chande Momentum Oscillator is calculated using the following formula:

- The result of the CMO oscillates between +100 and -100.

- A positive CMO value indicates that recent price gains are stronger than losses, while a negative value suggests that losses are stronger than gains.

2. Range:

- The CMO moves within a range of +100 to -100.

- Values above +50 indicate an overbought condition, signaling a potential trend reversal to the downside.

- Values below -50 indicate an oversold condition, signaling a potential trend reversal to the upside.

3. Interpretation:

- Overbought Condition: When the CMO is above +50, it suggests that the asset is overbought, and a price correction or reversal to the downside may occur soon.

- Oversold Condition: When the CMO is below -50, it indicates the asset is oversold, and a reversal to the upside may be imminent.

- Divergence: Traders also use CMO to identify divergences between the price and the oscillator. For example:

- Bullish Divergence: If the price is making new lows, but the CMO is not, it may suggest weakening selling pressure and a potential reversal upward.

- Bearish Divergence: If the price is making new highs, but the CMO is not, it may indicate weakening buying pressure and a potential downward reversal.

4. Advantages:

- Sensitivity: The CMO is more sensitive to price changes compared to some other oscillators like the RSI because it considers both upward and downward price movements in its calculation.

- Eliminates Smoothing Bias: Unlike other oscillators, the CMO does not use smoothing, which means it can more accurately reflect the raw momentum of price changes.

5. Usage in Trading:

- The CMO can be used similarly to other momentum oscillators like the RSI or Stochastic Oscillator. Traders often use it to time entry and exit points, particularly when the indicator reaches extreme values (overbought/oversold).

- It can also help identify trend continuations or reversals by observing when the oscillator crosses above or below certain thresholds (e.g., +50 or -50).

- When combined with other technical indicators, such as moving averages or trendlines, the CMO provides further confirmation for buy and sell signals.

Limitations:

- False Signals: Like many momentum oscillators, the CMO can sometimes produce false signals, especially in sideways or choppy markets. The indicator may suggest overbought or oversold conditions, but the price may continue to move in the same direction.

- Lag: Since it is a momentum oscillator, it may lag behind sudden price movements, which can result in delayed signals in fast-moving markets.

Conclusion:

The Chande Momentum Oscillator is a powerful tool for identifying momentum, overbought/oversold conditions, and potential trend reversals. Its unique calculation method, which includes both gains and losses, allows it to be more responsive to price changes than some other momentum indicators. However, it is often best used in conjunction with other technical analysis tools to avoid false signals.